Features

Financial Reports & Markets

Specialty papers face common challenges

Producers of specialty papers are being battered by market changes, and will need to be nimble and innovative to survive, said the experts at Specialty Papers US

March 14, 2017 By Cindy Macdonald

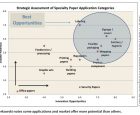

Photo: Smithers Pira

Photo: Smithers Pira Mar. 14, 2017 – Think of yourselves as providers of specialty products for a changing world,” Graham Moore advised the papermakers at Specialty Papers US 2016. He provided big-picture view of global trends in society, politics and economics for the audience at the two-day conference in Chicago, Ill.

Moore is a strategic consultant with Smithers Pira, which, in concert with TAPPI, produced the Specialty Papers conference.

The specialty papers sector must continue to innovate, said Moore. In terms of social influences, manufacturers should consider the aging population and the “ubiquitous” consumer, who can check prices online at any time and treats the retail shop as a showroom. The implication, said Moore, is that consumers may start to question your pricing because they can compare with other providers, and can check your price inputs. “The retail cull has only just begun,” he predicted. “I think we’ll see more and more of people trying to make their voice heard.”

A paper company looking to go beyond its own borders should consider the following political influences, he said: the growth of conservative nationalism, Brexit, the closing of borders and the growth of trade barriers.

Moore also suggested that as people are growing bored with their smartphones, tablets and laptops, perhaps paper will become a premium product, a novel way of presenting information.

On the legislative front, Moore warned that the industry will see local enactment of global directives, especially on the environmental front. “Expect continued ‘hardening’ on the use of specific chemicals in certain paper products,” he noted. One example would be an expected ban on the use of BPA in thermal papers in Europe.

New players push into specialty markets

Reviewing global paper industry trends, Matt Elhardt of Fisher International, confirmed that tissue and towel is still a growing segment, as is the specialty paper sector, driven by demand from Asia. Demand for printing and writing grades is flat and newsprint is declining. Packaging grades are growing rapidly, he noted.

The growth of specialty paper grades in North America and Europe is grade dependent, said Elhardt, with some increases in release papers and hygiene applications.

The question Elhardt hears frequently is, “What other grades can we make on our existing assets?” These grade conversions are a threat to specialty papers because they could increase supply, he said. There are now 1.7 million tonnes of specialty grades being made on printing and writing machines that were not making specialties 10 years ago.

Elhardt had a suggestion for specialty paper producers. Transportation costs are fairly low now, so there is an opportunity to find a niche offshore, he said. “Global trade is not only for the big commodities in pulp and paper.”

“Companies that are able to identify opportunity and are able to leverage it, will win,” he stated. He commented that most paper companies don’t do a very good job of turning market information into market intelligence. He is also of the opinion that this industry develops robust information management systems for the back end and for manufacturing, but not for sales and market information. Elhardt believes the companies that are good at rapid opportunity identification and execution and use that skill to get ahead of their competitors will be the winning specialty paper companies. He said there is space in the market for higher value packaging and retail-ready packaging. He also suggested there will be a market opportunity for papers with a small carbon footprint.

Consolidation meets diversity

The changes in the specialty papers industry over the last five years have been very dramatic, said Frank Perkowski, president of Business Development Advisory. He noted that consolidation has streamlined the product offerings from most mills, and mills which produce commodity products are still showing a tendency to shift production to specialty products.

Changing product requirements “are being driven to a large degree by increased targeting and micro-marketing,” Perkowski said. The growth in customer SKUs is still shifting demand to digital print and smaller run sizes, he added. Integrated solutions and higher performing materials are increasingly required.

The macro trends that are driving change — sustainability, food and product safety, convenience and globalization — translate to a need for more and increasingly diverse products, said Perkowski. The implication for specialty paper producers is pressure for product and process development. “This spells doom for mills that don’t have the capabilities to respond.”

Small but nimble

John Leness, president and chairman of the board for Southworth Company, spoke about the transformation of his 175-year-old, family-owned paper company. Southworth was a manufacturer of fine writing paper, focusing on cotton fibre paper. In the last 10 years, management realized this was a declining niche and wrestled with how to reposition the company.

In 2012, there was an opportunity to sell the branded writing paper business, and so Southworth did just that. Then it needed to find new business.

Leness noted it quickly became apparent that the culture of the business was very inward-looking. Employees were not accustomed to change, or to developing or adding new products, and they were not open to new ideas and there was little emphasis on quality, he said.

Southworth is now slowly redefining who it is, explained David Mika, chief financial officer. He said the company is exploring the capabilities of its “one little paper machine” in terms of colours, materials, number of product changes in one day. “We have found there are niches that we can play in.”

The company has been renamed Turners Falls Paper, and now mostly serves business-to-business markets, performing contract manufacturing, producing art boards, engineering drawings and papers with fibre inclusions.

“We can fill our mill with small jobs,” said Leness. “If we were a machine tool company, we’d be called a job shop.”

What’s new in paper technology?

On the technical side, Specialty Papers US presented information on innovations in fibres, fillers, coatings and strength agents.

Weiguo Cheng of Nalco Water noted with the degradation of the recycled fibre supply, strength becomes an issue. When using recycled material, if a paper producer doesn’t add fresh filler, the stock can still have five to 10 per cent filler content at the headbox.

Cheng explained the efficiency of conventional strength agents, such as cationic starches, decreases at higher ash content. So Nalco aimed to develop a new strength agent that would be efficient and effective, that would not be affected by high ash content and that would not affect charge balance.

The result is Nalco’s Metrix Titan technology, a program that delivers enhanced productivity, dewatering and strength development. Cheng said the new strength agent actually improves starch efficiency.

He cited one case study in which a manufacturer of release papers was able to increase production because of the improvement in press dewatering when using Metrix Titan. The producer also experienced a significant improvement in formation.

Representatives of West Fraser Forest Products presented at Specialty Papers US, encouraging the substitution of BCTMP pulp for kraft in certain applications. Jim Stymiest, manager of North American pulp sales for West Fraser, explained that a combination of kraft and BCTMP pulps lets a papermaker “dial in properties.” Kraft contributes strength and runnability, while BCTMP offers bulk, absorption and opacity, he said.

Stymiest also noted that BCTMP has lower thermal conductivity and lower thermal diffusivity than kraft pulp, and higher heat capacity, so there may be opportunities in cup stock and cold/frozen food containers.

An oft-repeated theme at Specialty Papers US heard was that papermakers must continue to innovate, must watch for opportunities brought about by changing markets or advances in technology, and must be able to react quickly. In other words, be smart and be nimble.

This feature was originally published in the Winter 2017 issue of Pulp & Paper Canada.

Print this page