Features

Research & Innovation

Billion Dollar Boost

This February Natural Resources Canada (NRCan) announced that Mercer International was the first company to receive funding under the Pulp and Paper Green Transformation Program (PPGTP), to the tune o...

April 1, 2010 By Pulp & Paper Canada

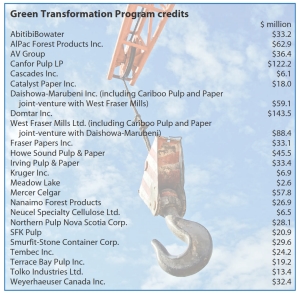

Green Transformation Program credits AbitibiBowater AlPac Forest Products Inc. AV Group Canfor Pulp LP Cascades Inc. Catalyst Paper Inc. Daishowa-Marubeni Inc. (including Cariboo Pulp and Paper joint-venture with West Fraser Mills) Domtar Inc. West Fraser Mills Ltd. (including Cariboo Pulp and Paper joint-venture with Daishowa-Marubeni) Fraser Papers Inc. Howe Sound Pulp & Paper Irving Pulp & Paper Kruger Inc. Meadow Lake Mercer Celgar Nanaimo Forest Products Neucel Specialty Cellulose Ltd. Northern Pulp Nova Scotia Corp. SFK Pulp Smurfit-Stone Container Corp. Tembec Inc. Terrace Bay Pulp Inc. Tolko Industries Ltd. Weyerhaeuser Canada Inc. $ million $33.2 $62.9 $36.4 $122.2 $6.1 $18.0 $59.1 $143.5 $88.4 $33.1 $45.5 $33.4 $6.9 $2.6 $57.8 $26.9 $6.5 $28.1 $20.9 $29.6 $24.2 $19.2 $13.4 $32.4

Green Transformation Program credits AbitibiBowater AlPac Forest Products Inc. AV Group Canfor Pulp LP Cascades Inc. Catalyst Paper Inc. Daishowa-Marubeni Inc. (including Cariboo Pulp and Paper joint-venture with West Fraser Mills) Domtar Inc. West Fraser Mills Ltd. (including Cariboo Pulp and Paper joint-venture with Daishowa-Marubeni) Fraser Papers Inc. Howe Sound Pulp & Paper Irving Pulp & Paper Kruger Inc. Meadow Lake Mercer Celgar Nanaimo Forest Products Neucel Specialty Cellulose Ltd. Northern Pulp Nova Scotia Corp. SFK Pulp Smurfit-Stone Container Corp. Tembec Inc. Terrace Bay Pulp Inc. Tolko Industries Ltd. Weyerhaeuser Canada Inc. $ million $33.2 $62.9 $36.4 $122.2 $6.1 $18.0 $59.1 $143.5 $88.4 $33.1 $45.5 $33.4 $6.9 $2.6 $57.8 $26.9 $6.5 $28.1 $20.9 $29.6 $24.2 $19.2 $13.4 $32.4 This February Natural Resources Canada (NRCan) announced that Mercer International was the first company to receive funding under the Pulp and Paper Green Transformation Program (PPGTP), to the tune of $40 million. Mercer will use the money to complete its Green Energy Project at its Celgar mill near Castlegar, British Columbia.

Mercer began the $55M Green Energy Project in May, 2008. It includes the installation of a 48 megawatt (MW) condensing turbine that will increase the mill’s installed generating capacity to 100 MW. Once the upgrade is completed in late 2010, the Celgar mill will able to use waste heat, turn more wood waste into more steam, and generate more bioenergy. Mercer reports that the Green Energy Project also includes upgrading the mill’s bark boiler and steam facilities.

NRCan announced the PPGTP in June, 2009, with the goal of funding pulp and paper mill projects that have environmental benefits. At the same time the PPGTP restores some balance in the North American industry, explains Catherine Cobden, vice president of economics and regulatory affairs, Forest Products Association of Canada. “There was a significant bioenergy subsidy in the United States. The PPGTP was a way to level the competitive playing field.”

Tom Rosser, director general, policy, economics and industry branch of Canadian Forest Service, which is a branch of NRCan, elaborates: “PPGTP is a Canadian program focused on the Canadian situation and Canadian needs. Pulp and paper is an increasingly global industry and Canada is a major exporter. As a result, the program design certainly took account of policy and market developments in the United States, Europe and elsewhere.” Too, he notes, “Pulp and paper is Canada’s largest industry energy user and it has a unique ability to power itself.”

One might also point out that the government is not indulging in hyperbole in pitching the PPGTP as an investment: P&P companies must spending the money on capital projects, which will yield enduring return on investment.

“The main objective of the PPGTP is to improve environmental performance at pulp and paper facilities in Canada. Sustainability and economic performance are increasingly interrelated, with strong environmental performance a source of competitive advantage. A lot of projects will be energy projects, but we also expect that projects will advance other environmental objectives, such as air and water quality. While energy efficiency is certainly an important part of environmental integrity, there is no special focus on it. We are not trying to privilege energy efficiency or air quality projects over green power or water quality, for example,” Rosser explains.

The first task of the PPGTP was to allocate credits to P&P companies: Any company that produced black liquor as of January 1, 2009 was invited to apply for a $0.16/litre credit. The cutoff date to apply for credits was last September 18. NRCan announced the credits on October 9.

Easy money

Twenty four companies, representing 38 mills, qualified. The size of the credits range from $2.6M for the Meadow Lake Mechanical Pulp Inc., to $143.5M for Domtar Inc.

The terms for turning credits into cheques are very user-friendly, Rosser explains. “What is really significant in terms of investments that are made is that companies that generate credits at one facility can use the money at any of their Canadian pulp and paper mills. So a much larger number of mills [than on that October, 2009 list of 38 mills] will be eligible for the PPGTP money. We want the recipient companies to be able to make the most efficient use possible of the credits.”

Even companies in receivership or under creditor protection, such as Fraser Papers and AbitibiBowater, were eligible for credits. “Whether a company is under protection in and of itself doesn’t affect their status under the program,” Rosser comments. Neither Fraser Papers and AbitibiBowater were forthcoming about their plans for PPGTP funds or any other capital projects they might launch this year.

There are more easy terms: It is of no consequence that construction of a project, such as Mercer’s Green Energy Project, might have started before the announcement of the PPGTP. Any costs incurred after the program announcement date last June are eligible for reimbursement, even those incurred by projects launched before the PPGTP approved them; that said, projects have to pass environmental review and meet the program criteria. Companies are not required to make matching funds. They need not use Canadian technology or expertise either, although Rosser comments, “I expect, though, that most or all projects will, in some way.”

Pilot projects are “absolutely” eligible. “Demonstrable environmental benefits is the only test. We expect to see a mix of projects come forward, ranging from those using more proven technologies to those based on more experimental technology,” Rosser says.

Companies can also use funds from other government sources to help fund their PPGTP projects. “Projects can be funded in whole or in part from PPGTP,” Rosser says. As well, companies do not have to produce finished, operational projects by the program cutoff date of March 31, 2012. They just have to spend their credits by then.

And yes, the program is capped at $1B, but the credits announced last October added up to only $950.4M. As of late February P&P companies had submitted project funding requests valued at $350M, and applications were still rolling in, according to Rosser.

Rosser declined to share specifics about exactly what projects companies were applying for. In the rough though, he says, “Energy efficiency projects will be significant. There are also local air and water quality projects. But the real focus will be on energy. The industry has set a goal for itself of becoming a net source of green power within a decade. The PPGTP will play an important role in helping them to get there.”

More PPGTP project spending

The significance of the PPGTP to the industry is evident when looking at the capital project spending patterns of P&P companies. Canfor Corporation, for example, reported capital spending of $39.9M in 2008 and $17.9M in 2009, but made no prediction for 2010 in its December quarterly report. With $122.2M in PPGTP credits, however, Canfor surely has extensive visions of sugarplums.

This March 6, opinion250.com reported that Canfor Pulp

Limited Partnership had submitted two projects to NRCan under the PPGTP, with a value of $15M: The first one will reduce odour emissions at its Prince George Pulp and Paper mill; the second will increase green power generation at the mill. The on-line news source notes that these two projects are part of a larger program of energy and environmental projects Canfor will undertake with its PPGTP credits.

In a November, 2009 information brief, Canfor explains that the odour reduction project will decrease total reduced sulfur, already cut by 80% in the 1980s, by half. The expected completion date is June, 2011. Equipment such as ducting, condenser and a reheater will be housed in a new building.

The biofuel power generation project is designed to generate an additional 11,000 mWh of electrical power. This project is expected to be completed by December, 2010.

According to the B.C. government’s major project inventory, Canfor is planning to spend $90 million for upgrades to the company’s Northwood pulp plant including replacement of the recovery boiler. A further $30 million worth of upgrades is planned for the feed water treatment system at Canfor’s Prince George pulp plant, which includes the addition of a precipitator to the exhaust system.

Although NRCan had made only one PPGTP funding announcement by early March, two other companies spoke with Pulp & Paper Canada magazine about their PPGTP credit spending plans. Northern Pulp Nova Scotia Corp., which has

$28.1M in credits, would like to make recovery boiler improvements at its 42-year old mill in Pictou, N.S. Other than that, says Don Breen, vice-president of strategic planning and government affairs, “We haven’t decided what we are going to do. We had a wish list of projects [before the PPGTP was created]. In the last three months we have looked throughout the plant to see what we can do. The studies are almost wrapped up. It is a good chunk of change and we want to spend it wisely.”

Northern Pulp has allocated between $2M and $2.5M capital spending for 2010 that is unrelated to the PPGTP, but which, juxtaposed with its PPGTP credits, certainly reflects their tremendous importance to the company. “The economic conditions in Canada are still not that good,” Breen observes. Northern Pulp is considering replacing some of its green and black liquor tanks and is shopping for a replacement bulldozer, which will cost about $200,000. This year is also the fourth year of a five-year electrical breaker upgrade program.

Another interesting news tidbit is that the Nova Scotia government is loaning Northern Pulp $75M to purchase 475,000 acres of land. Although Breen does not count this as a capital expenditure, why split hairs in these hard times? After all, the Canada Revenue Agency regards land as a capital acquisition. Aside from the 570-acre mill site the company owns, this will be its first ever land holding.

Domtar announced in its Q4 2009 report that its estimated capital expenditures for 2010 would be in the range of $160M to $180M, excluding PPGTP-funded projects. About $100M of that will be on maintenance and environmental projects across its 15 P&P mills. The total is well up from the $106M it spent in 2009, almost all of which was on maintenance and environmental projects. Domtar spent next to no discretionary dollars in 2009, according to Pascal Boss, vice-president, corporate communications and investor relations.

This year will be much happier. “It would not be a stretch to say that when we started 2009 it looked like the economy was going down the drain. Will this be a capital U recovery or a W? The jury is still out. Our financials are stronger and we can look to the future with a lot of confidence,” Boss says.

Capital projects this year will increase energy production and energy efficiency, with upgrades to the most recent technologies, according to Boss. “We will be improving operating efficiency and throughput by reducing bottlenecks.”

At its Kamloops mill, Domtar will upgrade the recovery boiler and reduce air emissions and build two new haystacks. “Our CEO John Williams has said that Kamloops will receive the lion’s share of Domtar’s PPGTP funds,” Boss says. Specifics will be made public when a contribution agreement is in place with NRCan.

When asked what Catalyst Paper might do with its $18M PPGTP credit, Lyn Brown, vice-president, corporate relations and social responsibility says, “Ours is a capital-intensive business, so $18M is a relatively modest sum to work with. We are currently assessing potential projects to be sure we put forward the most optimal projects. We haven’t yet finalized any decisions.”

Beyond that, she adds, “Cash preservation remains a priority going forward,” echoing the company’s 2009 year end report, in which it warns, ” … a cautious approach with regards to capital investments in 2010 …”

SFK Pulp reported last December that in response to winning a Hydro Quebec contract to purchase power co-generated by biomass, it would increase its green energy production capacity by 9.5MW, to 42.5MW. Noting that it has a $20.9M PPGTP credit, it reported that it, “will be submitting the turbo generator project of its Saint-Flicien mill for program approval.”

In an announcement attributed to Fredericton’s Daily Gleaner, AV Group plans to spend $45M in upgrades at AV Nackawic, including increasing its dissolving pulp production by 25%, to 600 tonnes a day. It also has plans this year for increasing energy efficiency, burning less oil, and improving the efficiency of its biomass burning operation. AV Group also wants to increase dissolving pulp production at Atholville by 30 tonnes per day.

In February, the Hinton Voice reported that West Fraser Mills Limited might spend some of its $88.4M of PPGTP credits on a $15M pressure diffuser in its Hinton, Alberta pulp mill.

Further illustrating just how difficult the economic environment is for P&P companies, Minas Basin Pulp and Power in Nova Scotia is still not prepared to go ahead with its $20M hog fuel boiler. “We worked all 2009 engineering it, getting environmental permissions. We are still working on the engineering, and when we feel we can do it, we will be ready to go,” says company vice-president Terry Gerhardt.

“Last year we put pretty well all of our cap-ex projects on hold. This year we are doing safety, environment, anything with a very quick return on investment. Anything with a two-year ROI is just not happening. We are going to spend some money on energy efficiency. They are not big projects, but they are definitely a priority.

“We should, by the end of 2010, likely go ahead with efficient lighting. We are putting our funds together. The ROI is less than one year, and that is one of the big reasons we are going forward. We are doing what we say we are doing: becoming an efficient, green mill.”

With the government’s PPGTP funding earmarked for energy and environmental projects, many other mills will be making strides in that direction over the next few years as well.

Carroll McCormick is a business writer based in Montreal.

PPC

Print this page