Features

Research & Innovation

DELIVERING SHAREHOLDER VALUE IN THE NEW MILLENNIUM

The TSE Paper & Forest Index has outperformed the TSE 300 so far this year, after significantly lagging in 1997-98. The Paper & Forest Index has climbed by 37.5% since late 1998 -- among the fastest i...

October 1, 1999 By Pulp & Paper Canada

The TSE Paper & Forest Index has outperformed the TSE 300 so far this year, after significantly lagging in 1997-98. The Paper & Forest Index has climbed by 37.5% since late 1998 — among the fastest industry sub-groups — and well above the 6.4% gain for the broad index. This reflects 1999’s strong earnings in North American lumber and oriented strandboard markets and investor anticipation of a broad-based, global recovery in pulp & paper prices over the next several years. Recent industry steps to boost shareholder value should also yield positive results for investors in the early years of the new millennium.

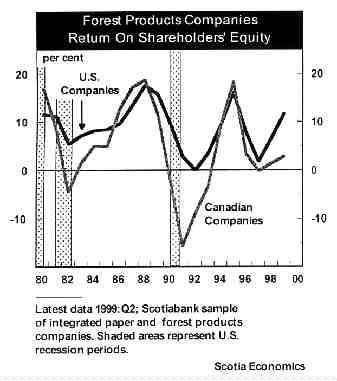

The quest for greater shareholder value, consisting of share price appreciation, dividends and other benefits needed to attract equity capital, became a major issue for the forest products industry several years ago. The last decade has been difficult for forest products companies, with the industry in both Canada and the United States not earning its cost of capital in many years. The return on shareholders’ equity for a sample of Canadian integrated forest products companies averaged only 0.2% per annum from 1990-98.

The roller coaster ride in pulp and paper prices over the past decade also increased earnings volatility and reduced investor confidence in the “sustainability” of earnings. Greater volatility was mostly due to the start-stop nature of G7 economic growth with a recession in the early 1990s, a mid-cycle slowdown linked to US anti-inflationary monetary policy in 1994-95 and then the Asian crisis of 1997-98. However, aggressive producer pricing practices also encouraged consumers to first build and then liquidate inventories between 1994 and 96, causing a huge swing in prices and profitability. Building shareholder value requires stronger and more “predictable” earnings for investors.

Canadian and US companies have recently addressed the issue of shareholder value creation in the following ways:

– by re-assessing global competitive strengths, re-focusing on “core” product lines and divesting assets outside the core or which do not meet target rates of return;

– through industry consolidation to reduce market fragmentation, cut costs, better manage inventories and increase international market presence;

– by a slower, more disciplined approach to capacity expansion, rather than chasing new projects and market share as in the 1980s and early 1990s; new product development, specialized customer services or marketing programs may yield higher dividends for shareholders;

– through the increasing use of Economic Value Added (EVA) principles which tie management compensation to positive EVA or the extent to which net operating income after taxes exceeds the cost of capital;

– in Canada, through a shift to higher value-added and more “differentiated” products with wider profit margins and more stable prices (in particular, the shift from standard grade newsprint to soft-nip and supercalendered papers);

– mill investment in more rapidly growing markets overseas (South Korea); and

– unlocking “hidden asset values” such as timberlands and hydroelectric capacity, which are not adequately reflected in share values.

The quest for greater shareholder value and an enhanced return on capital is contributing to a major slowdown in mill capacity expansion — in newsprint in Canada and the United States and in printing and writing papers in the United States and Europe. Overall US printing and writing paper capacity will rise by only 1.6% per annum from 1998-01, compared with annual gains of 4.8% in the 1990s. US additions to uncoated freesheet capacity will slow to 1.1% from 1998, half the 2.1% pace of the past decade. Newsprint capacity in the United States will actually fall by 0.2% per annum through 2001. This slowdown, combined with a more synchronized pick-up in global growth, should help to lift mill operating rates and bolster profits early in the new millennium.

Recent merger activity in newsprint has been striking and points to a more cost-competitive industry, with greater ability to manage inventories. The top 10 newsprint manufacturers — including Abitibi-Consolidated, Stora Enso, Bowater, Norske Skog and Donohue — now account for 57% of world capacity.

Considerable consolidation has also occurred in US and European printing and writing papers. However, the fine paper sector remains relatively fragmented compared with other industries such as autos and oil. The top five graphics paper manufacturers only account for 20.6% of world capacity — well below the 37% for the top five newsprint producers. (Graphics paper includes the four grades of printing and writing papers plus newsprint.) Further merger activity in fine paper would not be surprising.

While investor interest has recently returned for Canadian pulp and paper companies, investor confidence remains fragile and considerable challenges lie ahead. Key among these are: rising competition in the US market from newly commissioned freesheet paper machines in China and Indonesia; tightening domestic fibre supplies and the need to move towards more intensive silviculture, and; ongoing competition from new mills based on low-cost plantation fibre in Latin America and the Far East. Working with advertisers and publishers to develop new print media products serving their needs in the Internet and e-commerce era will also be a major challenge.

Patricia M. Mohr is Vice-President, Economics, Scotiabank, Toronto, ON.

Print this page