News

Open Innovation: Harnessing External Ideas and Leveraging In-House R&D Outside

November 1, 2003 By Pulp & Paper Canada

Companies are increasingly rethinking the fundamental ways in which they generate ideas and bring them to market [Henry Chesbrough, MIT Sloan Management Review, Spring 2003]. Intellectual property rig…

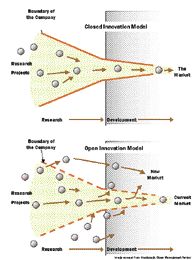

Companies are increasingly rethinking the fundamental ways in which they generate ideas and bring them to market [Henry Chesbrough, MIT Sloan Management Review, Spring 2003]. Intellectual property rights and internally generated technology are becoming less valued; early recognition of market opportunity, speed to market and a unique technology strategy for execution are the new value standards. There is an important transition that is taking place from an old “closed innovation” model to a new “open innovation” logic. Here the focus is on both internal and external mining for ideas and their effective adaptation to meet new market opportunities.

In times past, internal R&D was a valuable strategic asset, but many established companies are encountering strong competition from upstart enterprises that conduct little or no basic research, but instead get new ideas to market through different processes. Dell, Cisco, Intel, Nokia, Genentech are examples of companies that acquired or adapted the technology they needed from outside by partnering, or investing in promising startups. The erosion of the “closed innovation” model towards the end of the 20th century has a number of driving factors:

Huge costs for the development of proprietary technology [Gillette spent over $1B in its development of the Mach 3 razor only to be potentially trumped by Schick’s recent 4-blade introduction].

Mobility of the knowledge worker makes it increasingly difficult to control intellectual property.

Growing availability of private venture capital, which has helped finance new companies.

Growth of “free knowledge” that is contributing to the commoditization of technology in many sectors.

In the “open innovation” model, companies use and transfer knowledge freely between internal and external domains creating a “porous” barrier between the firm and its outside environment. Open innovation is based on a landscape of abundant knowledge that is used as a commodity by smart organizations that are able to proactively recognize opportunity and exploit potential idea-synergies.

Many industries are currently in transition from closed to open innovation. For such businesses innovations have emerged from unlikely sources. The locus of innovation has migrated from central laboratories to various startups, universities, consortia and other outside organizations. P&G has recently changed its approach to innovation, extending its internal R&D to the outside world through the slogan “Connect and Develop.” The company has created the position of Director of External Innovation and has set a goal of sourcing 50% of its innovations from outside the company in five years.

These trends have created new types of organization for generating innovations. The most interesting newcomer is the freelance “hired gun” for creative problem solving [www.innocentive.com and www.ninesigma.com]. P&G, Eli Lilly, Dow, BASF, DuPont and Kohler are among top clients for web-based problem solving that attracts many inventors from India, Russia and China, where rewards of $5,000 to $100,000 for a successful idea are a big deal. A checklist for choosing the “right channel” for outside innovation sourcing has been defined in a case study of successful practitioners [Linder et al, MIT Sloan Management Review, Summer 2003]. Five broad categories are identified: buying innovation, investing in innovators, co-sourcing, community sourcing and resourcing.

Why is this important?

In many ways the Pulp and Paper manufacturing sector has already embraced open innovation principles with the steady decline of proprietary corporate research and an increasing reliance on suppliers, partnerships and consortia. It is a world where proprietary technology is taken out of the competitive equation. What remains is competition in the early recognition of market opportunity and a unique technology acquisition and development strategy. With about $90B in venture capital currently looking for new opportunities in the early stages of research discovery, one might ask the following questions:

Where is our organization located on the continuum between closed and open innovation?

Do we have a model for innovation or novel ways to create value?

What is the health of our partnering capabilities?

“Companies that can harness outside ideas to advance their own business while leveraging their internal ideas outside their current operations will likely thrive in this new era of open innovation,” Chesbrough [Harvard Business School]. “Not all smart people work for us” Bill Joy [Sun Microsystems].

Alan R. Procter is an international consultant helping organizations exploit the future in their business strategies. He can be reached through www.alanprocter.com#text2#

Print this page