Features

Financial Reports & Markets

Packaging

Paper

Pulp

Tissue

Paper and forestry products outlook negative in 2020, says Moody’s

December 12, 2019 By P&PC Staff

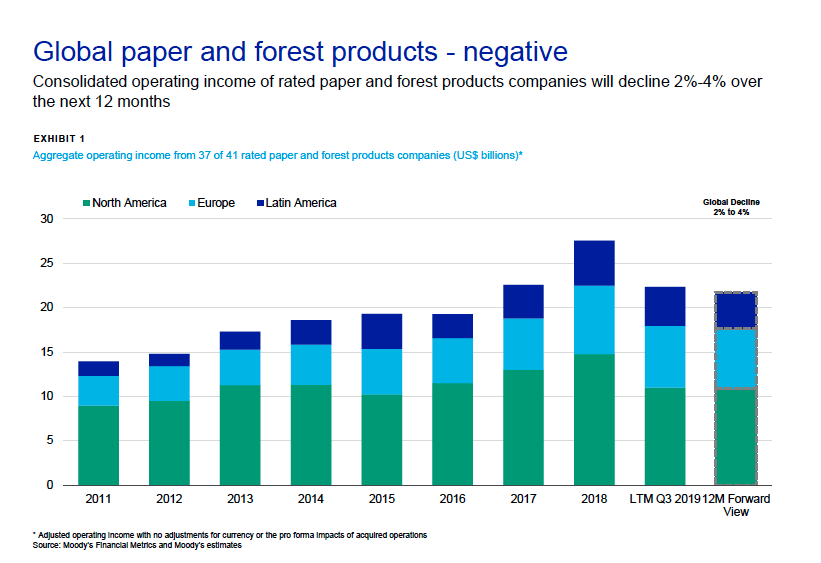

Consolidated operating income of rated paper and forest products companies will decline 2-4% over the next 12 months. Photo: Moody's Investors Service

Consolidated operating income of rated paper and forest products companies will decline 2-4% over the next 12 months. Photo: Moody's Investors Service The outlook for the global paper and forest products industry in the coming year remains negative, Moody’s Investors Service says in its 2020 outlook for the sector.

Earnings from paper, paper packaging and market pulp will all decline primarily as excess supply causes prices to fall. Wood products is the only subsector that will see improvement.

“We expect operating earnings for the global paper and forest products industry to decline by two per cent to four per cent in 2020,” says Ed Sustar, a Moody’s senior vice-president. “Lower prices across most sub sectors will be the primary driver for lower earnings, as well as the ongoing secular demand decline for paper, partially offset by lower costs for recycled fibre.

Paper packaging and tissue

In the paper packaging and tissue subsector, operating earnings will decline by about two per cent in 2020 on the back of lower corrugated container prices, given capacity additions haven’t yet been absorbed by weaker demand growth. Consumer packaging and tissue prices will stay at current levels, while recycled fibre costs will remain below the long-term average as China’s contamination restriction lessens its imports.

The report also indicates average containerboard prices in North America will fall four per cent in 2020, and possibly even further thereafter if most of the announced machine conversions to packaging grades occur at the same time. Approximately 1.2 million tons of new containerboard capacity will start up in late 2019 and early 2020 at mills across North America – that’s three per cent of North American capacity instead of the annual 1.5 per cent demand growth.

The rise in e-commerce and environmental concerns about plastic packaging will increase paper packaging demand, but will be partially offset by right-size packaging.

Approximately 280,000 tons of new tissue capacity will start up in 2020, representing about 2.5 per cent of North American capacity. That is higher than the annual demand growth of one to two per cent. Moody’s predicts that higher-cost capacity will be curtailed to ensure favourable supply and demand conditions.

North American paper packaging and tissue companies generate most of the global rated sector’s operating income. Photo: Moody’s Investors Service

Commodity and specialty paper

Operating earnings for commodity and specialty paper firms, meanwhile, will fall by about five per cent, with commodity paper consumption also set to decline by about five per cent due to digital substitution.

Prices will fall for most grades of commodity paper, as curtailments have not kept pace with declining demand. Nevertheless, specialty and non-integrated commodity paper producers will benefit from lower pulp and recycled fibre costs.

Moody’s also predicts demand for some specialty paper grades will increase as consumers switch to paper-based substitutes over single-use plastics such as paper cups and straws.

Market pulp

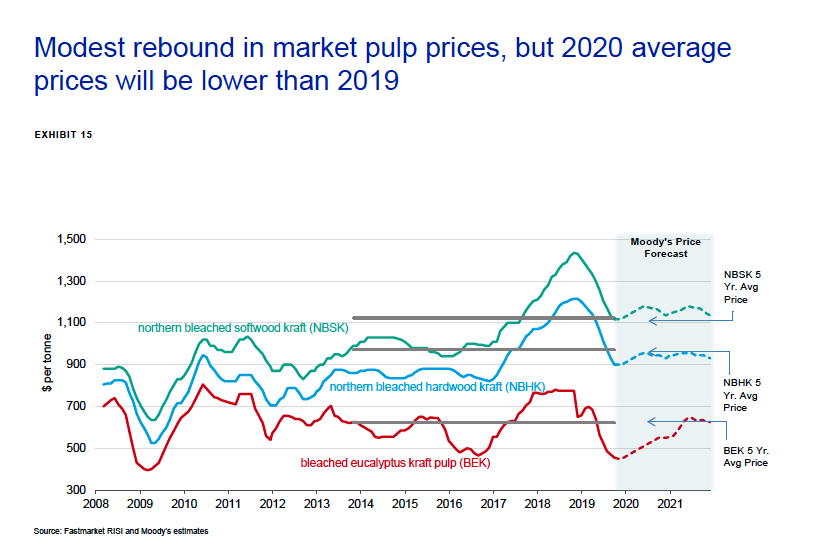

Market pulp producers will see operating earnings decline by around nine per cent in the coming year, Moody’s says, driven by excess inventories and lower average hardwood and softwood pulp prices. Although pulp prices will begin to rise as inventory levels normalize, average prices in 2020 will remain below 2019 levels.

Demand for pulp will remain muted as orders slow, particularly from China amid high trade tensions with the US.

The report says there are few pulp expansion projects planned until after 2020 – however, approximately 575,000 tonnes of new pulp capacity will start up in 2020, which is inline with annual demand growth.

Moody’s predicts pulp capacity may exceed demand starting in 2021 if announced expansion projects start at the same time.

Modest rebound in market pulp prices, but 2020 average prices will be lower than 2019. Photo: Moody’s Investors Service

Wood products and timberlands

Conversely, operating earnings for the wood products and timberland subsector will increase by about seven per cent in the coming year. North American wood product prices will rebound as capacity curtailments remove some slack from the market – Moody’s predicts average North American lumber prices to increase 10 per cent in 2020.

Canadian lumber margins will continue to be affected by countervailing and anti-dumping duties on Canadian lumber exports to the US, but the report says those duties will likely be refunded after a new lumber deal is negotiated.

US housing starts likely will be flat, while US South log prices likewise will stay flat on the back of excess inventory of standing timber.

Global credit risks

The credit rating agency identifies six points that will affect global credit, and thereby the paper and forest products sector, in 2020:

- Recession risks are rising during the current global economic slowdown.

- Political risks ranging from domestic policy changes to geopolitical uncertainty.

- Digital technologies are being used to scale up and transform traditional business.

- Interest rates are lower for longer due to an increasing share of assets globally.

- Trade tensions between the US and China are still a concern.

- Climate and environment risks are constraining the availability of capital for the most-exposed sectors

Print this page