Publication grades are in a clearly weaker position due to slow advances in paper-based advertising and to the Asian over-capacity situation. Both coated wood-containing and woodfree prices fell in th…

Publication grades are in a clearly weaker position due to slow advances in paper-based advertising and to the Asian over-capacity situation. Both coated wood-containing and woodfree prices fell in the US market by 5-10 USD/ton in January and the negotiations over first half of 2006 pricing in Europe have been very difficult in these grades. Indirectly, the uncoated groundwood sector is impacted, especially as some of the newsprint capacity has been converted to produce uncoated or coated mechanicals.

On the pulp market, the demand has continued lively. Supply shortfall from Central European mills which are suffering from wood procurement problems caused by the weather conditions and by the increased use of wood as fuel and from some of the Asian mills which have either wood supply or technical problems, has sent some buyers looking for alternative sources. The mill closures seen in North America in 2005 have added to the changes in the supply patterns. Inventories in the supply chain are below normal and the port stocks in Europe came down nearly 100,000 tons in January. There is no shortage of pulp but the availability of spot volumes is low enough to support the sellers’ efforts to get price increases through.

Hardwood producers joined the softwood suppliers and announced price increases both in Europe as well as in the US market. The announced increases have not gone through without resistance but they have continued their gradual march upwards, both in BSKP and BHKP.

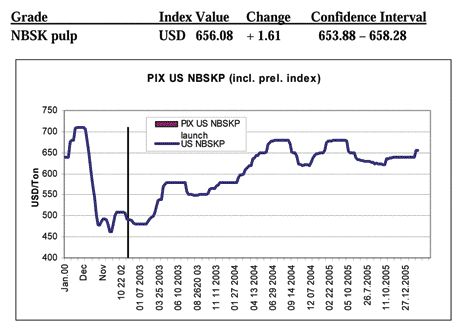

In the North American pulp market, recent and pending closures of pulp capacity go hand-in-hand with the shutting down of paper and board machines. There is little increase, if any, in market BSKP demand but with the capacity reductions, supply/demand ratio is sufficiently good to support the pricing initiatives. Some buyers continue to resist the BHKP price increase attempts but in NBSKP the announced increase to 660 USD/ton has largely gone through already. The quotes ranged from 640-660 USD with the majority of the prices received at 660. The US NBSKP index climbed 1.6 USD/ton, or 0.25%, and closed at 656.08 USD/ton.

ABRIDGED VERSION. FOR COMPLETE INFORMATION, PLEASE VISIT THE FOEX WEBSITE AT WWW.FOEX.FI, PHONE: +358-9-439 1030

Print this page