Features

Research & Innovation

RETURN ON EQUITY REACHESDOUBLE DIGITS IN FIRST QUARTER

Northern bleached softwood kraft (NBSK) pulp prices have posted a significant recovery -- jumping by 39% from the February 1999 low to US$680 per tonne in the US in April/May 2000. The rally has contr...

June 1, 2000 By Pulp & Paper Canada

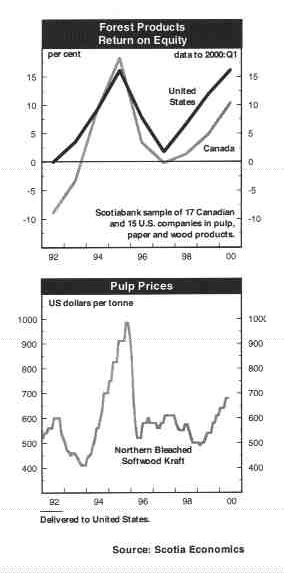

Northern bleached softwood kraft (NBSK) pulp prices have posted a significant recovery — jumping by 39% from the February 1999 low to US$680 per tonne in the US in April/May 2000. The rally has contributed significantly to a substantial improvement in corporate profitability, with “market” pulp accounting for about one-quarter of Canadian forest products exports. The return on equity for a Scotiabank sample of Canadian pulp, paper and wood products companies climbed to 10.4% in 2000:Q1 from 9.5% in 1999:Q4 and only 0.9% a year earlier.

It is interesting to note that the higher 16.2% return on equity posted by US companies in the first quarter — shown in the accompanying chart — reflects the extraordinary 36 to 37% returns achieved by two R&D-intensive, consumer tissue manufacturers. The lower return for Canadian companies also mirrors developments in the newsprint sector, a large component of Canada’s product mix. North American newsprint prices have lagged behind gains achieved in pulp, fine paper and paperboards over the past year, although another price increase for newsprint is expected by the fourth quarter.

“Sold out” market conditions for pulp — with the Norscan shipments-to-capacity ratio averaging 99.3% in the first quarter — reflect strong print-media advertising activity around the world, especially in the U.S. and Asia. American magazine ad pages — an important indicator for lightweight coated paper which requires NBSK in its furnish — surged by 14% year-over-year in April and have advanced by 12.2% so far this year. Dot.com advertisers — wishing to build brand names for their web sites — have driven up the cost of spot television ads and have turned to less expensive print media. Catalogue circulation (US) — also important for coated paper demand — posted a robust 5.3% gain in the first quarter and will be very strong over the balance of 2000, ahead of a planned postal rate hike early next year.

Tight market conditions for pulp also reflect a sharp slowdown in international capacity expansion over the past three years, after record mill additions in 1995-96. World capacity of chemical paper-grade “market” pulp rose by less than 1% last year, but will accelerate modestly by 2.4% in 2000 and 2.8% in 2001.

Current financial returns in pulp and paper are at mid-cycle levels, with further gains expected through next year. Strengthening economic conditions in Asia and Europe should offset the effect of gradually tightening monetary policy in the US, intended to slow growth to a more sustainable, non-inflationary pace. In the US, GDP advanced by a torrid 5.4% (annualized) in the first quarter and 7.3% in late 1999, raising concern over the inflationary implications of rising employment costs. However, East Asian growth will accelerate this year, with China already reporting a solid 8.1% year-over-year gain in the first quarter, South Korea 12.8% and Hong Kong an exceptional 14.3%.

Pulp prices have rebounded back to normal levels of profitability. At US$680 per tonne in the United States, prices are slightly above the US$610 average of the 1990s (a period of relatively weak pulp prices). Another US$30 hike has been scheduled for July by two major North American producers — likely followed by other Canadian manufacturers. However, the easy gains in pulp prices may be over.

Nordic producers would prefer to wait until September before lifting pulp prices further. This probably reflects the April slowdown in Norscan mill shipments, with producer inventories climbing back to 22 days’ supply from 19 in March. A one-week strike by Finnish pulp workers — a temporary factor — was partly responsible for reduced shipments. However, a development of greater concern is the difficulty encountered by European paper makers in passing through pulp cost increases to buyers. The price (in euros) of Eucalyptus pulp has almost doubled since early 1999 — partly due to the sharp depreciation of the euro/US dollar rate. Eucalyptus pulp prices now represent 69% of the price of A4 copy (B grade) paper in Europe — close to the peak 71% of late 1995 — just prior to a sharp correction in pulp prices.

It will be important to see a reversal of US dollar strength against the euro — expected by the end of 2000 — to provide some local currency price relief and ensure further gains in pulp prices next year. The euro/US dollar rate reached 0.889 in early May — 24% below its 1.175 rate at inception in early 1999 — before edging up to 0.931 on May 26. The German Bundesbank president has indicated that the euro is 20 to 30% undervalued in view of strengthening European economic conditions. For example, GDP in France expanded by 3.3% year-over-year in 2000:Q1, driven by vibrant export growth and robust consumption. A somewhat stronger euro would reduce European import prices and underpin additional gains in consumer spending.P&PC

Patricia M. Mohr is Vice-President, Economics, Scotiabank, Toronto, ON.

Print this page