Features

Paper

Pulp

The Pixelle Mill closure: What it means for the labelling industry in North America

December 12, 2022 By Alaina D'Altorio

A recent news announcement brings yet another devastating blow to the paper industry.

The Pixelle Mill in Jay, Maine, United Stated will officially close its doors.

This news comes during a volatile time in the labelling industry where raw material shortages continue to run rampant.

But paper mill closures aren’t new. We’ve watched many mills shut down over the last decade.

So why is this mill closure different from others?

The mill was a huge supplier of paper release liners in North America. And we’re currently in the middle of a release liner shortage.

Here are the details surrounding the announcement and why it’s such a monumental loss.

On September 20, 2022, Pixelle Specialty Solutions LLC announced the upcoming mill closure.

The Androscoggin mill will continue to run through Q4 2022. While they initially stated the mill would shutter its doors in Q1 2023, it was later announced that machines will continue to run until Q2 2023. While this gives the company time to plan ahead with customers, it doesn’t make receiving the news any easier.

News of the shutdown comes only two years after a catastrophic explosion rocked the facility.

Back in April 2020, a pulp digester exploded, destroying part of the mill and temporarily halting production.

This event dealt a huge blow to their entire operation because it removed the part that made them fully integrated.

And that’s a key feature that made the Androscoggin mill special.

Full integration meant this location was able to produce its own pulp, allowing for controlled costs instead of having to buy from outside suppliers.

The pulp making process also meant the mill was generating its own energy; yet another way to cut costs and save money.

While the mill was able to bounce back within a week after the explosion, Pixelle decided not to rebuild the pulp digester.

Instead, they chose to source pulp from out-of-state suppliers, and focus their attention on running the mill’s two remaining paper machines to produce higher-margin specialty products.

But purchasing pulp instead of making their own meant the mill was forced to buy pulp at the current market price. Without generating its own energy through its integration process, additional money went to energy costs.

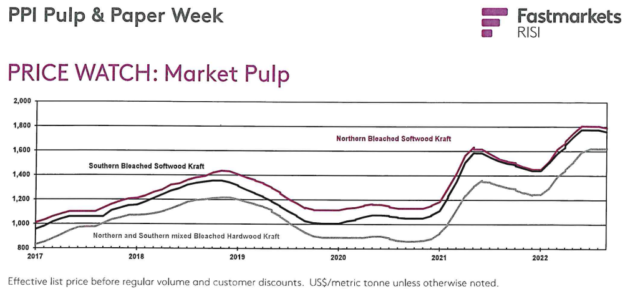

Prices for pulp and energy sharply rose throughout the pandemic. While pulp prices had been steadily increasing since the beginning of 2017, the industry saw multiple rounds of record highs, especially within the last year.

Northern Bleached Softwood Kraft (NBSK) rose 18.2 percent and Southern Bleached Softwood Kraft (SBHK) was up 17.3 percent from September 2021 to September 2022, according to recent data by RISI.

Specialty grades saw an even higher increase at 19 percent for Unbleached Softwood Kraft within the same time frame.

So looking back, the decision to not rebuild the pulp digester left the mill running on borrowed time.

Unable to continue under their previous business model, the mill’s operations became unsustainable.

And now the market is left without a major supplier of release liner.

Let’s break down some numbers.

About half a million tons of release liner are needed for the North American market.

As the largest manufacturer of specialty paper in North America, the Androscoggin mill had the capacity to produce 230,000 tons of specialty label and release papers annually.

The mill closing removes around 20 percent to 30 percent of release liner from the market.

All of this comes amid a global paper shortage that’s been ravaging the pulp and paper industry for the last several years.

Earlier this year, the UPM strike further delayed the supply of crucial materials by at least 1 month.

Point blank, we just lost a huge supplier of release liners. And there’s no saviour coming to the rescue.

Label manufacturers are struggling to survive.

They’re doing their best to acquire materials, but the lack of available supplies is leaving them in a bind.

Because it’s not just one supplier with no stock of paper liner; it’s all of them.

If companies hope to still acquire available label products for their customers, they must consider making a crucial move to alternative options.

Many are being forced to switch to synthetic release liner materials to overcome the shortage.

Enter in: the rise of PET (polyethylene terephthalate) liner.

While linerless labels are also an option, the market is leaning toward PET as a more effective alternative to paper liner. Switching to linerless also requires huge investments:

- Buying new printers

- Excessive maintenance

- Acclimating customers

And customers are looking for a solution that works now.

As the release liner shortage rages on, here are several predictions we can make about the future state of the labelling industry:

- PET Liner corners the market – Paper release liner supplies will likely continue to be short throughout 2023. Label consumers will be forced to integrate more PET liner options. As high demand for e-commerce, retail businesses, and delivery services will continue to expand film liner usage as synthetic materials become the new normal. PET liner will make its way to more print and apply applications than previously seen.

- Linerless label interest grows – Linerless label usage could see rapid growth. As the sustainability trend continues to expand, suppliers will market more linerless label products to their customers with the pretense that brands can “go green.” We could see a spike in linerless label technology and innovation to make the product more accessible to large volume and machine applications. However, the conversion process will take time as investments in new printers is necessary. Only certain applications will be able to use linerless labels as it’s not a drop in product for most companies.

- A reliance on imports – Without another efficient mill like Androscoggin, laminators could look outside of North America for relief. While China has available liner, tariffs, transit costs, and operational complexity means it is not an economically attractive option. Therefore importing liner from South America, South Africa, and other parts of Asia and Europe could become viable if qualifications can be met. However, offshore options are typically smaller mills. Logistics issues like increased transit times, additional capital, and rising interest rates means higher prices for customers.

The punches continue to roll in and knock out forecasts of when supplies will officially stabilize, the labeling industry needs to consider some radical changes.

Because these conditions are crippling businesses and leaving label manufacturers, converters, and suppliers with nowhere to turn.

This article is republished with permission from Alaina D’Altorio.

Print this page