Features

Financial Reports & Markets

Packaging

Paper

Tissue

Handling tumultuous times in the tissue and towel market

Stay-at-home orders, social distancing guidelines and consumer panic buying have created major irregularities in tissue and towel market dynamics and consumption patterns

September 4, 2020 By Richard Cho

Photo: Solenis

Photo: Solenis The unfolding of the past several months has led to more unpredictability than any of us could have imagined.

Stay-at-home orders, social distancing guidelines and consumer panic buying have created major irregularities in tissue and towel market dynamics and consumption patterns.

These challenges also present a great opportunity to help tissue and towel producers adapt and respond to these sudden changes.

Pushing for productivity

As consumers around the world actively stockpiled supplies and household staple items, tissue makers were pushed to maximize production.

In some countries, bath tissue sales increased by more than 50 per cent during the early months of the pandemic.

Though machine utilization rates spiked to nearly 100 per cent, there were still difficulties meeting demand.

Our teams at Solenis partnered with tissue makers across the globe to help optimize wet-end process and coating stability to improve productivity and paper quality.

For example, many of our customers leveraged the OPTIX Applied Intelligence adaptive analytics platform to optimize their papermaking processes and meet quality targets.

We have documented successes in reducing off-spec tissue production by helping customers significantly improve wet tensile target adherence and reduce variability.

Alternative-fibre tissue is seen as more environmentally friendly and sustainable. However, non-wood pulps typically contain higher levels of contaminants, such as silica and fines, which create Yankee coating challenges related to hardness, dusting and abrasiveness. Photo: Solenis

Managing fibre supply challenges

Tissue made from recovered fibre accounts for approximately 30 per cent of global production. Over the past few months, the recovered paper market has experienced extreme volatility.

An unprecedented surge in tissue and packaging board demand, combined with reductions in office wastepaper and old corrugated cardboard availability, has tightened supply.

This has forced some tissue makers to switch from higher-quality office waste to lower-quality alternatives, which can result in lower strength and increased wet-end contamination.

We have collaborated with a number of these tissue manufacturers, helping them evaluate and modify their dry-strength and contaminant control solutions to overcome these challenges.

An increasing number of tissue makers are also producing tissue made from non-wood alternative fibre, such as bamboo, which is not related to the pandemic per se, but it is exacerbating some of the other challenges affecting the industry.

Non-wood tissue accounts for approximately 10 per cent of global tissue production. Though more common right now in the Asia-Pacific market, non-wood tissue will continue to expand across the other regions. In fact, several recently launched direct-to-consumer tissue brands are selling 100 per cent bamboo tissue outside of Asia.

This type of tissue is seen as a more environmentally friendly and sustainable alternative.

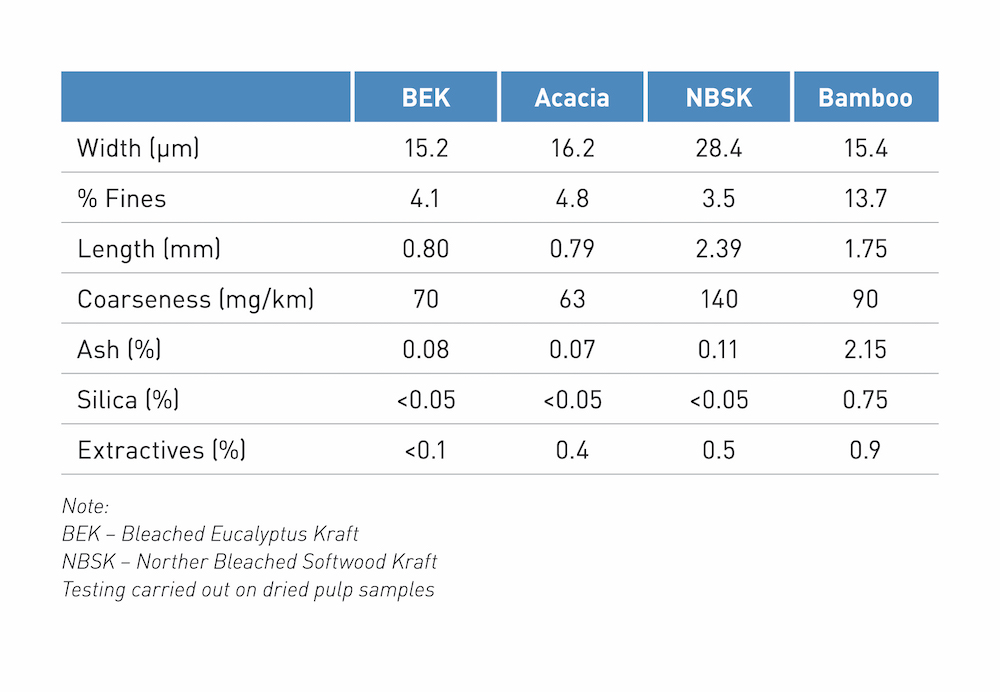

However, non-wood pulps typically contain higher levels of contaminants, such as silica and fines, which create Yankee coating challenges related to hardness, dusting and abrasiveness.

Tissue makers must address challenges related to improving softness/hand feel, machine runnability and extending doctor blade life.

Preparing for new paper towel opportunities

In the wake of the global pandemic, there is a renewed emphasis on hand hygiene that has resulted in more hand washing and hand drying occasions.

Many establishments are also replacing hot and jet air dryers with paper towel dispensers in public restrooms. In addition, experts recommend cleaning and disinfecting high-touch surfaces at least once a day to minimize the risk of COVID-19 transmission via surface contact.

All of these trends are driving an increase in paper towel usage and pushing manufacturers to enhance their product requirements.

Post-COVID-19, the world will likely operate very differently. Suppliers must evolve as much as the customers they serve, which is why we must actively work to enhance, extend and redefine our capabilities to align with the changing world.

Richard Cho is marketing director, tissue and towel at Solenis.

Print this page