Features

Financial Reports & Markets

Packaging

Paper

Pulp

Tissue

Pulp, paper and packaging face a decade of transformational change

The paper and forest-products industry is moving into an exciting decade, one that will see nothing less than a wholesale transformation of the industry

December 2, 2019 By Peter Berg & Oskar Lingqvist

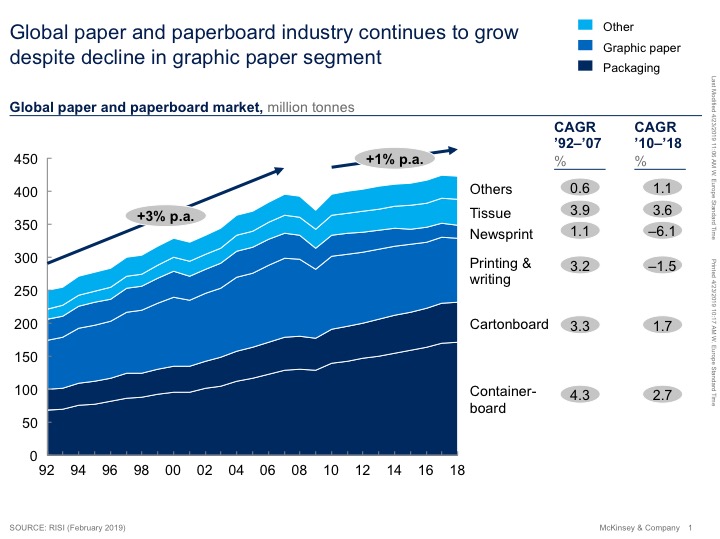

The global paper and paperboard industry continues to grow despite decline in graphic papers. Graphic papers include newsprint, printing and writing papers. Photo: McKinsey via RISI

The global paper and paperboard industry continues to grow despite decline in graphic papers. Graphic papers include newsprint, printing and writing papers. Photo: McKinsey via RISI Despite what we see in the media, the paper and forest-products industry is not disappearing – but it is experiencing the most substantial transformation we have seen in decades.

Other products are filling the gap left by the shrinking graphic paper market (Exhibit 1). Packaging is growing worldwide, along with tissue papers, and pulp for hygiene products. Pulp for textile applications is also growing (although still a relatively small market), while a broad search is underway in numerous labs and development centres for new product applications.

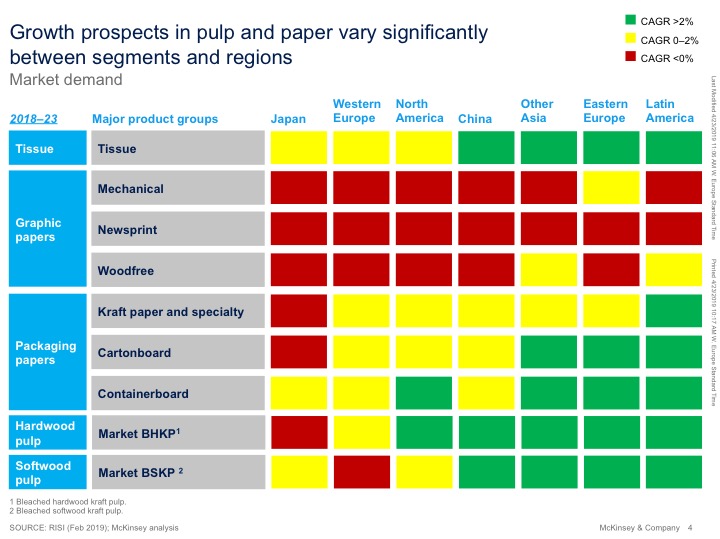

Demand for fibre-based products is set to increase globally, with some segments growing faster than others (Exhibit 2). However, there is uncertainty over how fast demand will grow in China. Previous growth expectations have proven optimistic and, given China’s weight in the global paper and board market, even modest changes have a major impact.

Growth prospects in pulp and paper vary significantly between segments and regions. Photo: McKinsey via RISI

How these demand trends translate into industry profitability will of course be heavily influenced by the industry’s supply side, and this is notoriously difficult to forecast more than a few years out; however, we believe the following to be realistic:

- Graphic papers, particularly newsprint and coated papers (but also uncoated papers) will continue to face a severe decline in demand and significant pressure to restructure production capacity. We are likely to see continuing machine conversions into packaging and specialty papers, as well as distribution and supply chain innovations. These structural changes are already having an impact with the profitability of graphic-papers companies reemerging from several years in the doldrums.

- Consumer packaging and tissue will be driven largely by demographic shifts and consumer trends such as the demand for convenience and sustainability. It will grow roughly on par with GDP. We expect innovation to be a critical success factor, particularly in the light of recent concerns over plastic packaging waste. However, we are uncertain how far packaging players can drive innovation by themselves: they may need to cooperate with retailers and consumer-goods companies in areas such as formats, use, and technology.

- Transport and industrial packaging will see opportunities for innovation in the intersection between sustainability requirements, e-commerce and technology integration. We estimate that e-commerce will drive roughly half the demand growth in transport packaging over the next few years. As packaging adapts to this particular channel, it will have to find new solutions to last-mile deliveries, the sustainability choice between fibre-based and lightweight plastic packaging, and the potential merging of transport (secondary) and consumer (primary) packaging.

- Fibre has gone through turbulent times in recent years, but its mid-term prospects are likely to favour producers, with little new capacity until 2021–22 and some softwood capacity likely to be converted to other products, such as pulp for textile applications. The lingering question is whether supply-side challenges can trigger an accelerated development of applications that are less dependent on wood-fibre pulp.

Challenges for the next decade

The paper and forest-products industry is often labelled as “traditional.” However, given the anticipated confluence of technological and demographic changes and resource concerns over the next decade, the industry will likely have to embrace change that is, in character as well as pace, vastly different from what we have seen before. This will pose significant challenges for CEOs in the way they manage their companies. We suggest there are three broad themes they will have to address through 2020 and beyond:

- Managing short-to-medium-term “grade turbulence.” This turbulence – for example, a higher level of uncertainty and overcapacity in packaging grades – poses challenges for companies. For CEOs looking to move into a new market segment, it will be vitally important to make the right choice. Where will I be the most competitive? How will my entry change market dynamics, and will this matter?

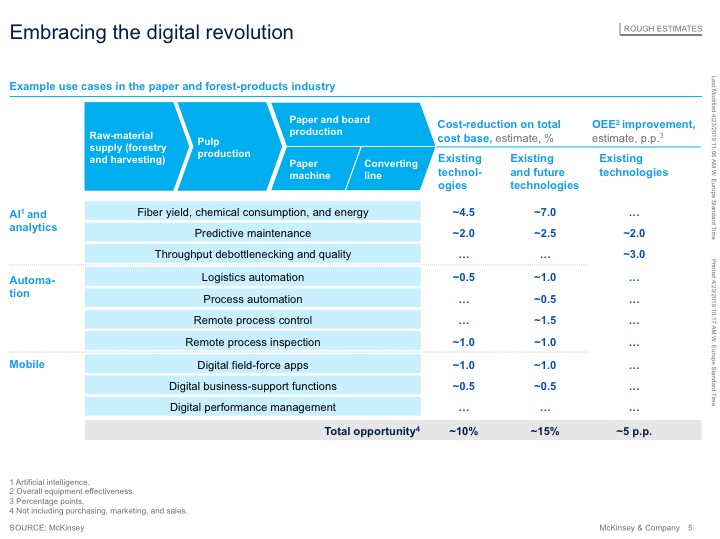

- Finding the next level of cost optimization. Low cost will remain a critical factor in financial performance. Companies must get a tighter grip on operating costs for paper and board production, with many needing to go beyond conventional approaches to the next level of cost optimization. The industry has much to gain from embracing digital manufacturing: this could reduce the total cost base of a producer by as much as 15 per cent. New applications such as forestry monitoring using drones or remote mill automation present tremendous opportunities for increased efficiency. This is also the case in areas where big data can be applied: for instance, to solve variability and throughput-related issues at each step of integrated production flows (Exhibit 3). The industry is well placed to join the digital revolution, as paper and pulp producers typically start from a strong position in terms of collected or collectable data. At the customer-facing end, the opportunity for innovation is huge with potential to create new industries, especially in packaging segments. Digital developments will also disrupt value chains, paving the way for direct B2C relationships between paper-product makers and end consumers – for example, in tissue products.

- Uncovering value-creating growth roles for forest products. Global trends are creating radical new opportunities for finding value-creating growth roles for forest products. For example, the industry’s historical linear value chains are giving way to more collaborative structures among players from within and beyond the industry: this includes new producer and distributor collaborations; pulp players collaborating more innovatively with non-integrated players; paper and packaging companies collaborating more intensively with retailers, consumer-goods companies, and technological experts; and new products such as bio-refinery products requiring novel go-to-market partnerships.

Peter Berg is a senior expert in McKinsey’s Stockholm office, where Oskar Lingqvist is a senior partner. Together they lead McKinsey’s global Paper & Forest Products Practice. This article was produced for Pulp & Paper Canada based on Berg and Lingqvist’s recent report on pulp, paper and packaging.

Print this page